In an exclusive interview with Crypto Unplugged podcast hosts Doc and Oz, Grant Cardone—a globally renowned fund manager, real estate mogul, and creator of the 10X Global Movement—shared his insights on Bitcoin, real estate, and the evolving landscape of finance. With a track record that includes managing a $4.7 billion real estate portfolio and raising over $1.4 billion via crowdfunding, Cardone offered listeners a masterclass in strategic investing, long-term thinking, and innovation.

Bitcoin’s Surge Reflects Growing Mainstream Acceptance

The conversation began with Bitcoin’s recent surge past $100,000, which both Doc and Cardone agreed was a testament to its increasing recognition as a mainstream financial asset. Cardone, who has been involved with Bitcoin since 2013, attributed this growth to its intrinsic characteristics as a digital and decentralised currency.

“Visa, MasterCard, and American Express are already operating as digital forms of money. Bitcoin is simply the next step,” he explained. Cardone sees Bitcoin’s rise as part of a larger shift toward digital finance, a space he believes is only beginning to mature.

Scarcity: The Common Ground Between Real Estate and Bitcoin

A key theme of the discussion was the principle of scarcity, which Cardone identified as a shared trait between Bitcoin and prime real estate. “When you buy institutional-grade real estate in Miami, New York, or Houston, there’s only one of that exact kind. It’s the same with Bitcoin—there’s a fixed supply of 21 million,” he said.

This scarcity underpins the value of both assets, making them highly attractive to investors seeking long-term stability and growth.

The Marriage of Opposites: Mitigating Risks by Combining Bitcoin and Real Estate

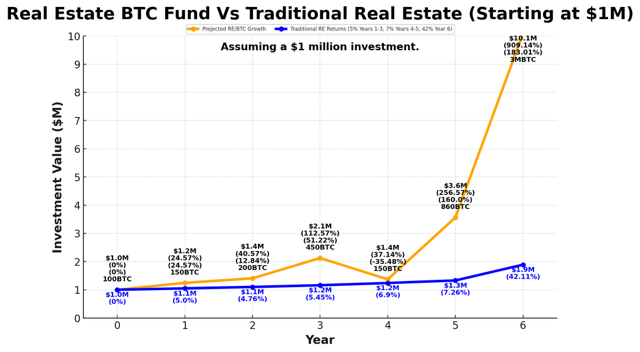

Cardone revealed how he’s innovating by blending the stability of real estate with the volatility of Bitcoin. His $88 million real estate fund, which integrates $15 million worth of Bitcoin, is designed to balance the risk-reward dynamics of these two very different asset classes.

“Real estate is illiquid and predictable, while Bitcoin is highly liquid and volatile. When you combine the two, you create a marriage of opposites that mitigates risk while offering explosive potential,” he explained. By dollar-cost averaging into Bitcoin using cash flow from real estate, Cardone’s fund maximises the benefits of both assets.

The Trump Administration and a Crypto-Friendly Landscape

When Oz asked about the Trump administration’s potential impact on the cryptocurrency market, Cardone was optimistic. He pointed to key pro-crypto figures in Trump’s cabinet, including Commerce Secretary Howard Lutnick and Donald Trump Jr. “I think you’ll see an announcement on January 20th that positions the U.S. as a global leader in the crypto space,” Cardone predicted, hinting at regulatory clarity and institutional adoption.

Unmasking the U.S. Economic Reality

Cardone didn’t shy away from critiquing the current state of the U.S. economy under the Biden administration. Calling it a “recession in disguise,” he pointed to rising credit card delinquencies, housing market stagnation, and misleading job statistics. “Many investors are still unaware of the true economic conditions,” he warned, emphasising the importance of asset-backed investments like Bitcoin and real estate as a hedge against economic uncertainty.

Altcoins: Essential for Industry Growth

Addressing the role of altcoins, Cardone dismissed the notion of competition between Bitcoin and other cryptocurrencies. “If Bitcoin is the only winner, there’s no industry. Competition creates growth,” he said. He acknowledged the flood of new tokens entering the market, likening it to the California Gold Rush. While not all projects will survive, Cardone believes this diversity is crucial for the sector’s evolution.

Education and Adding Value in the Crypto Space

For newcomers, Cardone stressed the importance of education and creating value. “Find something you’re good at and combine it with crypto,” he advised, pointing to his own strategy of integrating real estate and Bitcoin as an example. “The crypto space is still young, and there’s massive opportunity for those who can innovate and add value.”

A Long-Term Strategy for Success

Cardone advocates for a long-term approach to investing, urging listeners to think in 10-20 year horizons. “Most people complicate everything and never get anywhere,” he said. His advice is simple: have a target, do the math, and pick a clear path forward. This disciplined approach, he believes, is the key to navigating volatile markets like crypto.

The Role of Government and Financial Disruption

While Cardone recognises the government’s pervasive role in finance, he also champions disruption. “The government isn’t going away—they’re like the mafia. But any advantage citizens can get, even if temporary, is worth pursuing,” he said. He sees decentralised finance (DeFi) as a critical step toward empowering individuals, albeit one that will coexist with traditional systems.

Assets Before Lifestyle: A Cardinal Rule

One of Cardone’s central messages was the importance of prioritising investments over lifestyle upgrades. “Quit trying to act like ballers when you’re not,” he said bluntly. “Invest in assets first, and let those investments improve your quality of life later.”

Bitcoin’s Million-Dollar Potential

Cardone is bullish on Bitcoin’s long-term potential, predicting it could reach $1 million by 2030. He attributes this optimism to increasing institutional adoption and the creation of innovative models like his real estate-Bitcoin fund. “We’re combining stability and explosive growth in a way that’s never been done before,” he said.

The Power of Innovation and Disruption

Cardone’s approach to investment exemplifies the power of innovation. By blending Bitcoin with real estate, he’s not just disrupting traditional finance—he’s paving the way for new investment models that balance stability with growth.

Conclusion

Grant Cardone’s insights, as shared with Doc and Oz on Crypto Unplugged, offer a roadmap for navigating today’s complex financial landscape. From integrating Bitcoin and real estate to emphasising education and long-term strategy, Cardone provides invaluable lessons for investors at every level.

As he aptly put it, “Disruption is inevitable. The key is to position yourself strategically, invest in assets, and create value in everything you do.”

Listen to the full podcast here for an in-depth discussion that dives deeper into Cardone's unique investment strategies, his bullish outlook on Bitcoin, and how he’s leveraging innovation to shape the future of finance. Whether you’re a seasoned investor or just starting out, this episode is packed with insights you won’t want to miss.

Discussion