Most people hear the term “10-year yield” and think it’s just another abstract figure buried deep in macro reports. But it’s far from that. This one number affects everything — from how high Bitcoin can fly to whether tech stocks keep climbing or get pulled back to earth. If you're trading risk assets, you’re already betting against or with this yield — whether you realise it or not.

How the 10Y Yield Moves Bitcoin, Stocks, and the Entire Risk Trade

When the 10Y yield drops, risk assets tend to rally. When it spikes, they typically sell off. It’s not theory — it’s the mechanics of pricing future value.

A falling yield suggests cheaper borrowing, more liquidity in the system, and higher valuations for assets that rely on expected future returns. That includes tech stocks, AI, growth sectors — and yes, Bitcoin. Rising yields do the opposite: they make capital more expensive and force markets to reprice everything based on tighter conditions.

It’s Not Just About the U.S. — It’s the Global Reference Rate

The 10-year Treasury yield is effectively the global cost of money. Around $100 trillion of financial assets — mortgages, corporate bonds, sovereign debt, equities — price risk and return off this single rate.

That means a sharp move in the 10Y isn’t just about U.S. policy. It can reprice debt in emerging markets, shift capital flows across borders, and send ripple effects through every portfolio manager’s model from Frankfurt to Singapore.

Why Bitcoin Traders Should Pay Attention

Bitcoin is pure duration. It doesn’t pay a yield, doesn’t have earnings, and doesn’t generate cash flow. Its value is based on long-term belief — the idea that it will matter more in the future than it does now.

When yields rise, that future belief gets discounted harder. When they fall, the long view gets a boost. You can think of higher yields as adding weight to an asset with no current fundamentals. It doesn’t take much for that weight to drag price down.

The 10Y Tells a Bigger Story

This yield doesn’t move on its own. It reflects market expectations around inflation, growth, policy credibility, and broader risk sentiment.

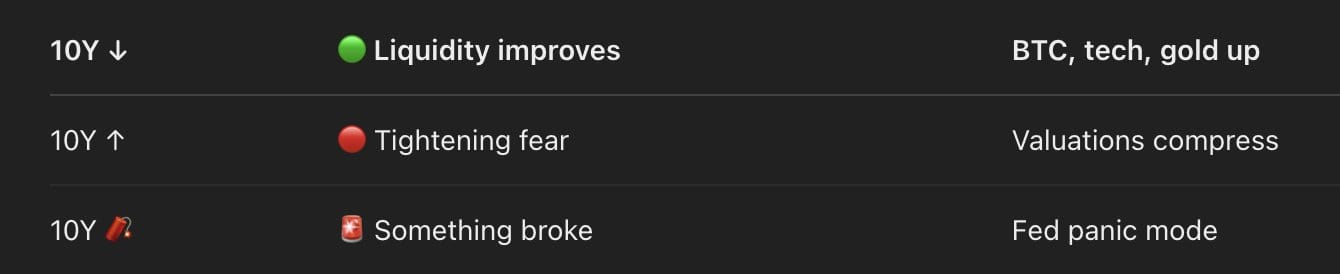

If the 10Y is falling, it’s often a signal that markets are anticipating weaker growth or policy easing. If it’s climbing, it may point to inflation concerns, tightening credit, or something breaking that’s forcing risk to be repriced.

That’s why traders and analysts track it so closely. Not just because it affects costs — but because it’s often the first signal that something big is shifting in the background.

Quick Reference: How to Read the 10Y

When the 10Y drops:

- Borrowing becomes cheaper

- Markets expect slower growth or a shift in monetary policy

- Risk assets like Bitcoin, tech, and growth stocks usually rise

When the 10Y spikes:

- Capital becomes more expensive

- Markets fear inflation or tightening conditions

- Risk assets typically correct or consolidate

The Macro Number That Can’t Be Ignored

The 10-year yield isn’t just for bond traders. It’s the benchmark that drives risk sentiment across every asset class — including crypto. If you trade without watching it, you're missing a key part of the picture.

It’s not abstract. It’s not academic. It’s the cost of belief in the future — and that’s exactly what markets are built on.

Discussion