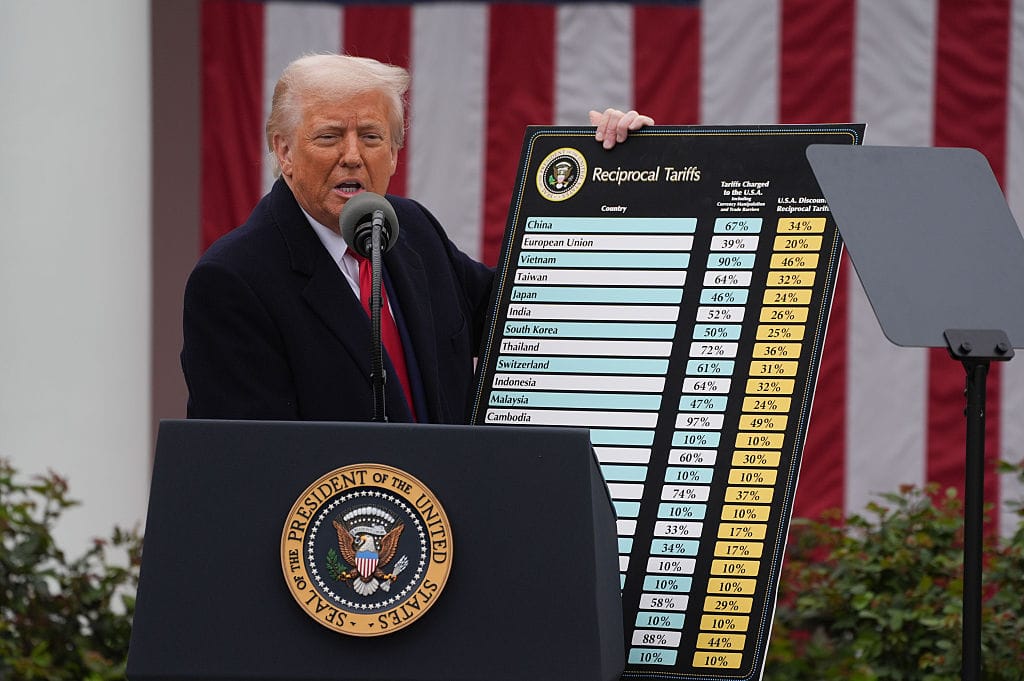

In 2018, President Trump introduced sweeping tariffs on approximately $250 billion worth of Chinese imports — 25% duties on everything from steel and aluminium to appliances and electronics. Media outlets called it an inflation time bomb. Markets flinched. Traders braced for CPI to surge.

And yet, nothing really happened.

Fast-forward to 2025, and the same narrative is starting to circle again: a potential Trump return equals global inflation risk. But if you understand what actually happened last time — both in the data and in the market response — it’s clear this is more political theatre than macro threat.

What Actually Happened With the 2018–2019 Tariffs

Let’s start with the facts. In 2018, the Trump administration levied multiple rounds of tariffs on Chinese goods, eventually covering over $250 billion worth of imports. These included core industrial inputs like steel and aluminium, along with consumer items such as washing machines, electronics, and appliances.

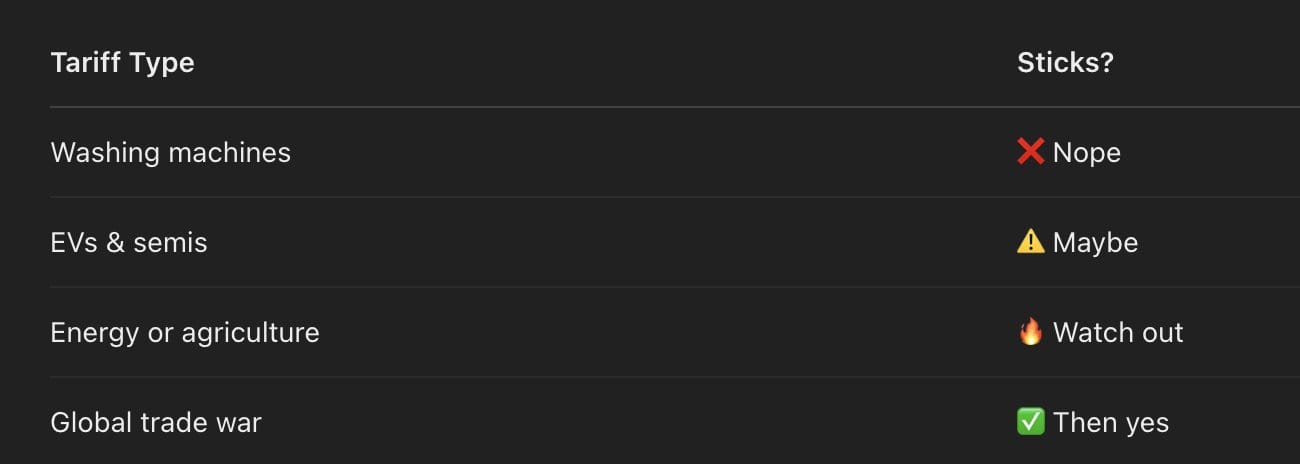

Consumer prices did spike — but only in the categories directly targeted. Washing machines, for example, saw price increases of 20–30%. But that’s where the impact ended. The broader CPI barely moved. Core inflation didn’t spiral. There was a short-term optical jump in select categories, followed by a return to trend.

Unless your investment portfolio was heavily weighted to household appliances, you didn’t feel it.

Why the Tariff Shock Didn’t Stick

There were several reasons the tariffs failed to generate lasting inflation:

- Corporations absorbed the costs to protect market share and pricing power.

- China devalued the yuan, softening the blow to U.S. importers.

- Consumers shifted behaviour, avoiding tariffed goods where possible.

- Supply chains quietly rerouted, with firms sourcing from alternative countries like Vietnam and Mexico.

The result? The so-called “tariff tax” was contained. It never turned into a self-reinforcing price loop.

Tariffs are, by design, a one-off price adjustment. They are not inherently inflationary in a structural sense — unless paired with wage growth, energy shocks, or currency devaluation that feeds into a lasting spiral. None of those occurred in 2018–2019.

The Fed Didn’t Blink — They Cut

One of the clearest signs that inflation fears were overstated was the Fed’s reaction. In 2019, the Federal Reserve wasn’t hiking rates to combat runaway prices. They were cutting.

The dominant concern at the time wasn’t inflation — it was slowing growth and deteriorating business confidence. Tariffs created uncertainty for multinationals, disrupted global supply chains, and weighed on sentiment — but they didn’t overheat the economy. If anything, they cooled it.

It was a macro cold, not a fever.

2025: Same Panic, Same Playbook

Today, with Trump polling strongly ahead of the 2024 election outcome, the inflation panic is resurfacing. Analysts are once again warning that “Trump 2.0” means a return to global inflation.

But let’s be clear — unless tariffs directly hit energy inputs, are combined with tight labour markets and rising wages, or result in a complete breakdown in global trade, the inflation threat remains overblown.

Tariffs are optical inflation — they move prices temporarily, not structurally. They hurt margins, not household budgets. They’re a headline tax, not a monetary one.

Tariffs vs Inflation: Understand the Difference

The CPI impact of tariffs looks like a spike, not a trend. Prices jump once, then level off. It’s not the start of a wage–price spiral like in the 1970s. It’s a one-time hit to cost structures that gets absorbed over time — either by companies, currency adjustments, or sourcing changes.

Yes, tariffs are disruptive. Yes, they can dent confidence and hurt equity valuations in targeted sectors. But they don’t create multi-year inflation unless supported by broader monetary forces — which aren’t currently in play.

Conclusion: Don’t Fear It — Trade It

In 2018, Trump’s tariffs triggered a wave of market volatility, especially in the industrial and consumer goods sectors. But the broader CPI barely moved, the Fed cut rates, and risk assets rallied once the panic faded.

If similar measures return in 2025, the most likely scenario is a repeat of the script:

- Brief market overreaction

- Limited CPI impact

- Fed remains focused on growth

- Opportunity, not catastrophe

This isn’t a policy to ignore — but it’s not one to fear either. If tariffs return, the right move isn’t panic. It’s preparation.

Discussion