What are Bear and Bull Markets in Crypto?

The cryptocurrency market is a wild place, and prices can go up and down a lot in a short time. This is often because of how investors feel about cryptocurrency, which can change quickly.

What is a bull market?

A bull market is when the price of cryptocurrency goes up over a long time. In a bull market, there is usually a lot of trading and people are feeling optimistic about cryptocurrency.

There are a few things that can start a bull market in cryptocurrency. These include:

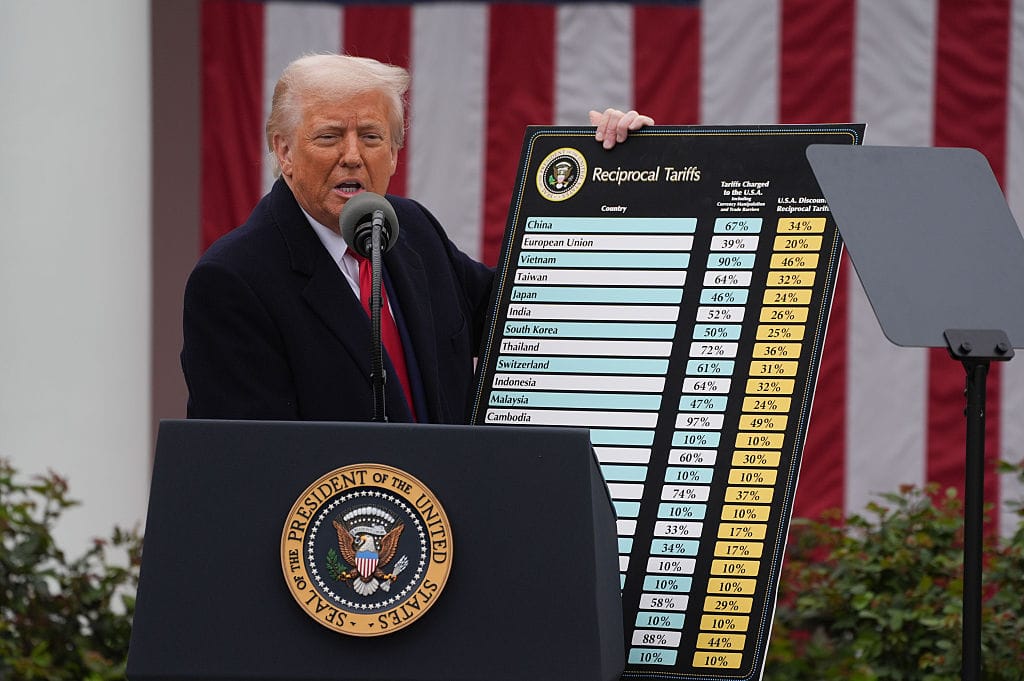

Positive news about the cryptocurrency industry. This could be a new cryptocurrency project, a big company adopting cryptocurrency, or positive government regulation.

More institutional investors getting involved in cryptocurrency. When big investors start buying cryptocurrency, it can drive up the price and make other investors feel more confident.

FOMO (fear of missing out). As prices start to go up, some people might start to feel FOMO, which means they want to buy cryptocurrency so they don't miss out on the gains.

What is a bear market?

A bear market is when the price of crypto goes down over a long time. In a bear market, there is usually less trading and people are feeling pessimistic about crypto.

There are a few things that can start a bear market in crypto. These include:

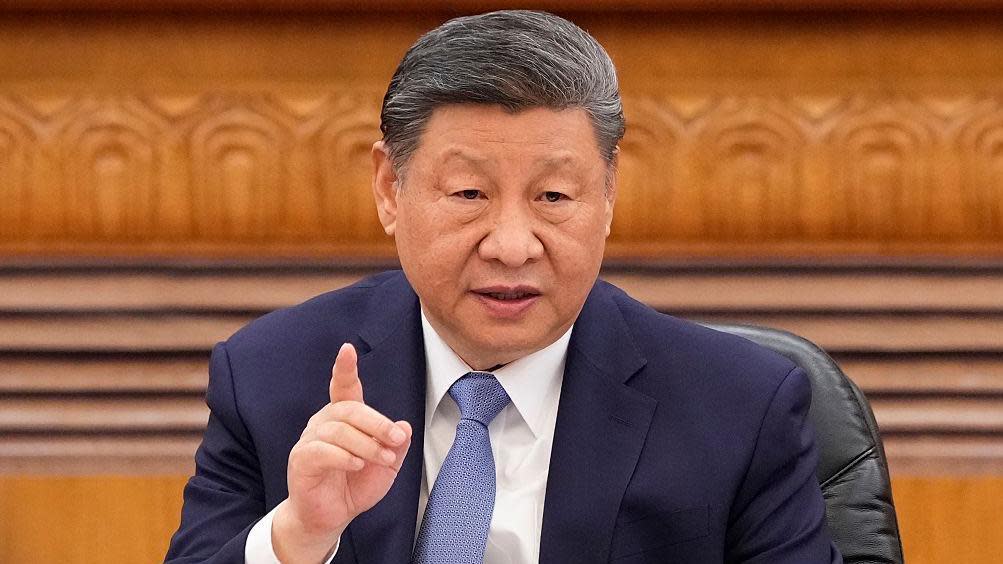

Negative news about the crypto space. This could be a big crypto project failing, a government regulating crypto, or negative media coverage.

Investors selling their crypto to cut their losses. When prices start to go down, some investors might sell their cryptocurrency to avoid losing money. This can lead to a self-reinforcing cycle of falling prices and more selling.

Capitulation. Capitulation is when investors have lost all hope and are selling their cryptocurrency at any price. This can lead to a sharp and sudden drop in prices.

How to trade in bear and bull markets?

There is no one-size-fits-all answer to this question, as the best way to trade in bear and bull markets depends on your individual trading style and risk tolerance. However, here are a few general tips:

- Do your research. Before you start trading, it's important to understand the factors that can affect the price of cryptocurrency. This will help you make informed decisions about when to buy and sell.

- Use stop-losses. A stop-loss is an order that automatically sells your cryptocurrency if the price falls below a certain level. This can help you limit your losses if the market turns against you.

- Be patient. Trading in bear and bull markets can be volatile, so it's important to be patient and not panic if prices start to move against you.

Conclusion

Bear and bull markets are a natural part of the cryptocurrency market. By understanding the factors that can contribute to these market cycles, you can be more successful in your trading.

Click to subscribe to the Crypto Unplugged Podcast.

Want to learn technical analysis and become a better trader in cryptocurrencies?

Our Premium Technical Analysis in Cryptocurrencies Course will teach you everything you need to know to start trading crypto like a pro.

In this course, you will learn:

The basics of technical analysis

How to use charts to identify trends and patterns

How to develop a trading mindset

How to manage your risk

And much more!

The course is taught by experienced traders who have been in the market for years. They will share their knowledge and expertise with you so that you can start trading crypto with confidence.

Sign up for the course today and start learning how to trade crypto like a pro!

Click here for more details.

Discussion