Most investors are watching CPI prints and Fed speeches, waiting for a clear signal that the next cycle has begun. But markets rarely move when everything is confirmed. They move before the headlines — when disbelief still dominates, velocity is stuck, and liquidity is building quietly under the surface.

This isn’t a market waiting for good news. It’s a market waiting for capital to realise the game has already shifted. If you know what to look for, the next stage is already unfolding.

Markets Don’t Explode When Everyone Feels Safe

The biggest moves never start with confidence. They start in confusion.

In 2020, risk assets began rallying when unemployment was still high, GDP was collapsing, and most market participants were frozen. It wasn’t clarity that triggered the move — it was the combination of disbelief and liquidity.

Today, the backdrop is eerily similar. Investors are still cautious, looking backwards at inflation, interest rates, and recession risk. But the structure beneath the surface is shifting — and those watching the right indicators know what’s coming.

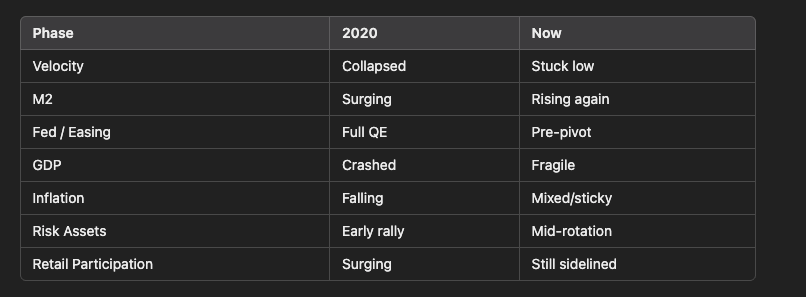

The Cycle Comparison: 2020 vs 2025

Here’s how today’s setup mirrors 2020:

- Velocity of money remains suppressed

- M2 is quietly rising again

- The Fed is boxed in, with little room to hike

- GDP remains fragile

- Retail participation is low

- Crypto and other risk assets are slowly bidding, ahead of confirmation

This is pre-breakout territory — not full-blown euphoria. And that’s exactly where asymmetric moves begin.

Why Prices Are Still Choppy Despite Rising Liquidity

A common question is: if M2 is rising, why aren’t prices taking off yet?

The answer lies in velocity.

Rising M2 simply means more liquidity is present in the system. But if velocity — the rate at which money flows through the economy — stays low, that liquidity doesn’t immediately turn into price action. It accumulates. It pools. It builds pressure quietly. The financial system is filling the pipes, not opening the floodgates.

When that pressure finally breaks through — often catalysed by policy shifts or sentiment flips — the move happens quickly and brutally.

2020 Was Fast. 2025 Is Quiet — But Familiar

In 2020, the shock was immediate. Central banks flooded the system, M2 exploded, and risk assets took off within weeks. The structure today is more subtle — but the foundation is nearly identical:

- Velocity is low, meaning demand and confidence remain cautious

- Liquidity is increasing, via global M2 expansion

- Real yields remain unattractive, keeping capital on the sidelines

- Risk is mispriced, as most portfolios are still positioned defensively

The difference? This time, capital is rotating more slowly — and smart money is positioning without making noise.

Big Moves Happen Before the Headlines Catch Up

The crowd waits for confirmation. But confirmation always comes after the re-pricing.

The edge lives in recognising when the data is turning but the narrative hasn’t caught up. That’s when the greatest risk–reward opportunities appear — not in certainty, but in the blind spot between fear and acceptance.

Right now, that blind spot is wide open.

Where We Are Now: Pre-Explosion Mode

All the ingredients are in place:

- Velocity is flat

- M2 is flowing

- Interest rates are stuck

- Charts are whispering early signals

We’re not in a macro boom. But we don’t need one. All it takes is misplaced capital and time — and both are abundant.

Crypto is already reacting. Bitcoin has held strength while broader markets drift. The rotation may not be loud, but it’s underway. Smart money is stepping in. Retail is still second-guessing.

This is where the cycle flips — quietly.

🧵 Where are we in the cycle?

— Oz (@AskCryptoWealth) April 6, 2025

Everyone’s watching CPI or the Fed.

But if you know what to look for — you’ll see it’s already underway.

Let’s break it down 👇

Discussion